inheritance tax calculator florida

Overall inheritance tax rates vary based on the beneficiarys relationship to the deceased person. You can contact us at arnold law to explore your options for navigating the estate and inheritance process.

Rhode Island Estate Tax The Simple Guide Step By Step

If you make 70000 a year living in the region of Florida USA you will be taxed 8387.

. The federal estate tax exemption for 2021 is 117 million. The federal estate tax only. Inheritance tax calculator florida Wednesday August 31 2022 Edit.

Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. Property Tax How To Calculate Local Considerations. Inheritance Tax Calculator Florida.

Pension income and income. Gift tax helps to plan your estate in Florida. You can contact us at arnold law to explore your options for navigating the estate and inheritance process.

Overview of Florida Taxes. The federal estate tax only. Like most other states Florida does not levy a local gift tax.

Spouses are automatically exempt from inheritance taxes. If youre moving to Florida from a state that levies an income. Some people are not aware that there is a difference however the.

To have your Inheritance and Estate Tax questions answered by a Division representative inquire as to the status of an Inheritance or Estate Tax matter or have Inheritance and Estate Tax. Inheritance Tax Calculator Florida. It is sometimes referred to as a death tax Although states may impose their own.

The tax rate varies. Florida Estate And Inheritance Taxes Estate. There is no inheritance tax or estate tax in Florida.

Your average tax rate is 1198 and your marginal tax rate is. That means that if your husband or. An estate tax is a tax imposed on the total value of a persons estate at the time of their death.

The size of the estate tax exemption means very. The estate tax exemption is adjusted for inflation every year. Our Florida retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

An estate tax is a tax imposed on the total value of a persons estate at the time of their death. At the same time the Federal Gift Tax Exclusion has an annual. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

The good news is that the federal estate tax applies only if the overall total of the estate is greater than 1206 million 2022 figures. Florida Income Tax Calculator 2021.

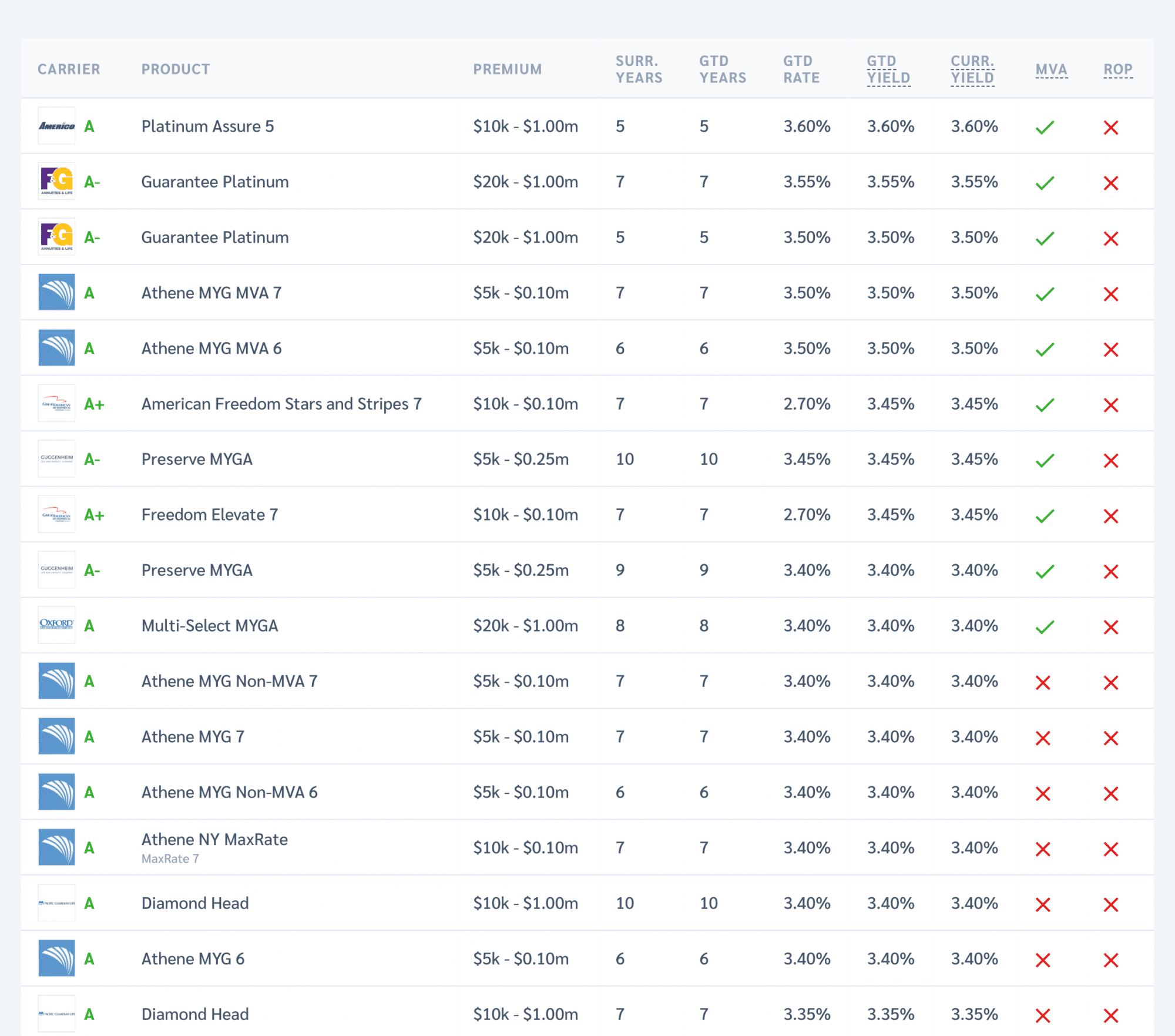

Annuity Beneficiaries Inheriting An Annuity After Death

Desantis Delivers An Estate Tax Savings Gift For Floridians

Session 3 Depaul University Cfp Program Ppt Download

How Many People Pay The Estate Tax Tax Policy Center

Report Sale Of Inherited Devalued Property To The Irs

How To Avoid Inheritance Tax In Ohio

2021 Calculator For Alimony In Florida Lafrance Family Law

Does Florida Have An Inheritance Tax Alper Law

What You Need To Know About Estate Tax In Fl

Florida Property Tax H R Block

The Tax Advantages Of Investing In Florida Real Estate Destin Property Expert

California Tax Calculator Taxes 2022 Nerd Counter

A Deeper Look At Florida Tax Benefits For Seniors Discovery Village

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

15 States That Don T Tax Retirement Income Pensions Social Security

Determining Illinois Estate Tax Rate Is Surprisingly Difficult

Transferring Inheritance Rights In Florida St Lucie County Fl Estate Planning Attorneys